Meet Jessica and Ashraf.

They’re first-time SaaS co-founders, experts in their field, out to solve a big problem and build a valuable company at the same time. They’re looking ahead to 2025 as a year of ambitious growth. They’re even considering pitching for investment. As they plan for next year, they want to make sure they’re measuring the right metrics to know if they’re on track.

They understand that SaaS metrics are different from traditional business metrics, but other than some Google and ChatGPT searches, they’re new to SaaS metrics.

“SaaS/subscription businesses are more complex than traditional businesses. Traditional business metrics totally fail to capture the key factors that drive SaaS performance.”

David Skok, SaaS Metrics 2.0

After digging a little deeper, we discover they have 4 questions they want answered:

- How will the value of our SaaS company ultimately be determined?

- What SaaS metrics should we focus on in the early days on our way to $1M ARR?

- How do we know what targets to strive for on these metrics?

- We’re not experts in finance. How should we track and view our SaaS metrics?

Are these questions you’d love answers to as well?

While each of these questions could justify a series of in-depth discussions on their own, in this article, we’ll share a foundation to get you started, and resources to help you go deeper.

How will the value of our SaaS company ultimately be determined?

Ultimately, the value will be determined by what someone is actually willing to pay. As explained by Ed Bryant, President & CEO of Sampford Advisors, in a MetricStack podcast https://saascan.ca/saas-and-tech-valuations/, SaaS valuations are determined as a multiple of your Annual Recurring Revenue (ARR). That multiple depends on a number of factors:

- Scale – What is your company’s ARR? $1M, $5 to $10M, over $10M? A lower scale is discounted, but after $10M ARR, there’s generally no discount on your revenue multiple based on scale.

- Revenue Growth Rate – What is your month-over-month or year-over-year revenue growth rate? The higher the better. Revenue growth rate is fueled by both initial sales to new customers and expansion sales to existing customers.

- Customer Logo and Revenue Retention – If this is low, why? Does your product not work? Do customers not get value after the first annual contract expires? Retention shows whether your product is sticky or not.

- Profitability – In the very early days this is less critical, especially for venture capitalists. However, it’s more important than it was a year or two ago to show a path to profitability. When will you be profitable? How will you get there?

- Market Conditions – Regardless of your performance on the factors listed above, your company’s valuation will be influenced by prevailing market conditions. SaaS Capital publishes The SaaS Capital Index https://www.saas-capital.com/the-saas-capital-index/, showing how SaaS valuations have changed over time.

What SaaS metrics should we focus on now in the early days, on our way to $1M ARR?

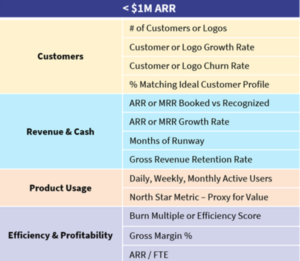

This is a question SaaSCan asked 4 dozen SaaS investors and lenders on a survey last year. They recommend founders like Jessica and Ashraf focus on 3 kinds of metrics in the early days, on the way to $1M ARR. These metrics help founders focus on finding Product Market Fit before they run out of money.

- Customer Metrics

- Revenue and Cash Metrics

- Product Usage Metrics

They also recommend early stage founders get familiar with key Efficiency and Profitability metrics, even if they’re not optimizing for these in the early days.

You can see the specific metrics SaaS investors and lenders recommend tracking below, depending on your context of course. Note that it’s better to start by tracking a small number of key metrics and expand from there. For definitions and examples of these metrics, as well as an AI metric assistant, check out MetricHQ.

Source: The Metrics That Matter Most for Startups in 2024

How do we know what targets to strive for on these metrics?

Follow a three-step process to set appropriate targets:

- Determine your baseline. Make sure you know where you’re at today a) so you put a stake in the ground and align as a team, and b) so you can gauge your progress over time.

- Document your assumptions. Do you anticipate expansion to multiple divisions in a company after you sell to the first division? Do you expect 25% of customers purchase a specific add-on that will be ready in Q2? Document these as part of your assumptions for Net Revenue Retention, for example, so you can adjust if reality plays out differently from your assumptions (not that it ever does!).

- Check relevant benchmarks for companies like yours. SaaS metric benchmarks can show you directionally what great looks like. In the early days when your revenue is under $1M ARR, don’t take them too literally though. Your data will be lumpy and inconsistent, and that’s normal. And don’t expect to hit top decile or even top quartile performance on multiple metrics right away. It’s common to excel in some areas, while lagging in other areas initially.

TIP: When you consult SaaS benchmarks, be sure to compare your metrics to those of companies most similar to you, for example, with the same Annual Contract Value and/or Annual Recurring Revenue. The first two studies below enable you to do that. The third provides general good, better, best guidance.

o OpenView

o Bessemer Scaling from 1 – 10M ARR

We’re not experts in finance. How should we track and view our SaaS metrics?

- Use an expert. Unless you or one of your co-founders has an accounting or finance background and is knowledgeable about SaaS metrics, invest in a Fractional SaaS Accounting service to make sure your chart of accounts is set up correctly for a SaaS business. They can also calculate your SaaS metrics for you each month.

- Chart your data. Consider using a platform like SaaSGrid https://www.saasgrid.com/ (free for SaaS companies < 1M ARR) to get a monthly view of your SaaS metrics in a pre-built dashboard. You can provide your data in a spreadsheet template, and SaaSGrid will calculate your metrics for you. You can also connect it directly to your source data if you prefer.

- Segment your data. Segmenting your data in several ways lets you test hypotheses and see trends you may not otherwise notice. Some common ways to segment your data are by:

- Type of customer

- Size of customer

- Customer industry vertical

- Month customer signed up

- Sales person (if you have sales people)

- Customer’s first goal or job to be done (if you follow a product-led growth approach)

In summary, Jessica and Ashraf, like many first-time SaaS founders, are eager to understand the key metrics that will help them grow their business and ensure they’re on the right path. From understanding how company value is determined to focusing on early-stage metrics related to finding Product Market Fit and tracking revenue growth, tracking the right data is essential. By setting appropriate targets and using tools to segment and monitor their metrics, founders can make informed decisions as they scale. By considering all of these factors, Jessica and Ashraf will be well positioned to dominate in 2025.

Lauren is the founder of SaaSCan where she provides Customer Success Advisory Services to global SaaS scaleups, and empowers Canadian SaaS startups through SaaS metrics research and mentoring. Over the past several years she’s provided SaaS metrics mentoring to over 100 Canadian SaaS founders like Jessica and Ashraf.